- Pdf Van Tharp Position Sizing Spreadsheets Free

- Pdf Van Tharp Position Sizing Spreadsheets Online

- Pdf Van Tharp Position Sizing Spreadsheets Template

- Pdf Van Tharp Position Sizing Spreadsheets 2017

Pdf Van Tharp Position Sizing Spreadsheets

Position Sizing Excel Spreadsheet. I will use an example of Expectancy from Dr. Position sizing and probability spreadsheet that. Strategies such as position sizing. Super Trader Commitment Agreement Van Tharp’s Super Trader Program is the most intense and challenging of the programs. Position Sizing: Van Tharp has some excellent tools and I would encourage you to seek out any additional education to help you. (The download link for the Excel file is below the video). In the August 2007 issue of Active Trader magazine, Volker Knapp (see Trading system lab: 'Percent volatility money management') tested a system that used. Optimal-f is fixed fraction position sizing that is optimal in a very. Pdf Van Tharp Position Sizing Spreadsheet Program If you are risking 1. Here we use the R multiple from the first chapter, standard deviations etc. Pdf Van Tharp Position Sizing Spreadsheet. Van Tharps Definitive Guide to Position. Pdf Van Tharp Position Sizing Spreadsheet Templates. 5/22/2019 0 Comments (If you already have an account, login at the top of the page) futures io is the largest.

Van Tharp & ‘R’ Multiples. It’s almost impossible to speak about trading in relation to risk & position sizing without mentioning the demigod in this field; probably the leading expert in position sizing & money management; namely Dr.Van Tharp Ph.D. Completed worksheets to help you develop your own trading business plan. When you leave. Understand why position sizing is so critical to your bottom.

Aplikasi gudang gratis full español. (If you already have an account, login at the top of the page) futures io is the largest futures trading community on the planet, with over 100,000 members. At futures io, our goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer. The community is one of the friendliest you will find on any subject, with members going out of their way to help others. Some of the primary differences between futures io and other trading sites revolve around the standards of our community. Those standards include a code of conduct for our members, as well as extremely high standards that govern which partners we do business with, and which products or services we recommend to our members. At futures io, our focus is on quality education.

No hype, gimmicks, or secret sauce. The truth is: trading is hard. To succeed, you need to surround yourself with the right support system, educational content, and trading mentors – all of which you can find on futures io, utilizing our social trading environment. With futures io, you can find honest trading reviews on brokers, trading rooms, indicator packages, trading strategies, and much more. Our trading review process is highly moderated to ensure that only genuine users are allowed, so you don’t need to worry about fake reviews. We are fundamentally different than most other trading sites: • We are here to help. Just let us know what you need.

• We work extremely hard to keep things positive in our community. • We do not tolerate rude behavior, trolling, or vendors advertising in posts.

Pdf Van Tharp Position Sizing Spreadsheets Free

• We firmly believe in and encourage sharing. The holy grail is within you, we can help you find it. • We expect our members to participate and become a part of the community.

Help yourself by helping others. You'll need to in order to view the content of the threads and start contributing to our community.

Pdf Van Tharp Position Sizing Spreadsheets Online

It's free and simple. -- Big Mike, Site Administrator. Hello, we are creating the script where we would like to use Percent Volatility Position Sizing Method described in Van Tharp's book Trade Your Way to Financial Freedom. I was wondering if anyone could help us out.

'MODEL 4: THE PERCENT VOLATILITY MODEL Volatility refers to the amount of daily price movement of the underlying instrument over an arbitrary period of time. It’s a direct measurement of the price change that you are likely to be exposed to-for or against you-in any given position. If you equate the volatility of each position that you take, by making it a fixed percentage of your equity, then you are basically equalizing the possible market fluctuations of each portfolio element to which you are exposing yourself in the immediate future. Volatility, in most cases, simply is the difference between the high and the. If IBM varies between 141 and 143% then its volatility is 2.5, However, using an average true takes into account any openings.

Thus, if IBM closed at 139 yesterday, but varied between 141 and 143% today, you’d need to add in the 2 points in the gap opening to determine the true range. Thus, today’s true ranges is between 139 and 143’&or 4% points. This is basically Wells Wilder’s calculation as shown in the definitions~at the end of the book. Here’s how a percent volatility calculation might~work for position sizing. Suppose that you have $50,000 in your account and you want to buy gold. Let’s say that gold is at $400 per ounce and during the last 10 days the daily range is $3.

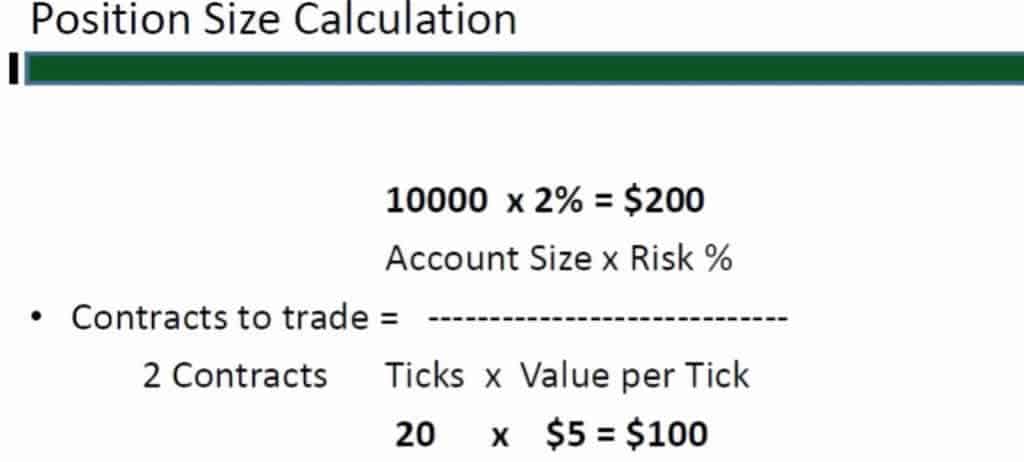

We will use a IO-day simple of the average true range as our measure of volatility. How many gold can we buy? Since the daily range is $3 and a point is worth $100 (i.e., the is for 100 ounces), that gives the daily volatility a value of $300 per gold contract. Let’s say that we are going to allow volatility to be a maximum of 2 percent of our equity. Two percent of $50,000 is $1,000. If we divide our $300 per contract fluctuation into our allowable limit of $1,000, we get 3.3 contracts.

Pdf Van Tharp Position Sizing Spreadsheets Template

The 'How Much' Factor: Your success as a trader has little to do with selecting the right investment or even having a great system. Instead, it has everything to do with the “how much” factor when you invest or trade. Investment professionals have called this factor “asset allocation” or “money management.” However, they failed to understand that the key aspect was “how much” to invest in any position. Others work so hard to get themselves a good system, but fail to realize that position sizing strategies are the key to getting what they really want. When you have a great trading system, it is certainly easier to meet your system objectives through your position sizing method; however, you still have a chance to meet your objectives and profit with an average system if you understand how to position size properly. Yes, your position sizing strategy is that important.For many years Dr. Tharp has specialized in helping traders and investors understand position sizing strategies and how to use them effectively.

He originally published The Money Management Report as his guide to position sizing methods. But thanks to an overwhelming demand from his clients, we’ve now published the book you’ve all been waiting for, Dr. Tharp’s Definitive Guide to Position Sizing.What You'll Learn When Dr. Tharp’s clients reviewed this book for publication, many found it so valuable that they did not want to return it once they finished their review.

Pdf Van Tharp Position Sizing Spreadsheets 2017

‘Monte Carlo & Mersenne Twister’ Trading Simulators Day Trading Simulation PDF FREE Trading PDF Trading Simulator Here’s another ‘FREE Trading Spreadsheet that you might find useful; A ‘Monte Carlo Expectancy Simulator.’ Several years ago I. THARP Foreword by David Mob& Sr. Xiii Acknowledgements xvii Preface xxi PART ONE. Ms project 2010 free download with product key download. What Do You Mean Position Sizing? I Only Have $10,000 in My Account! 280 Position-Sizing Strategies 284 Model 1: One Unit per Fixed Amount of Money286.

This video is unavailable. Watch Queue Queue. Watch Queue Queue. Dec 27, 2017 Zy Zy polnaya versiya StrangCraftTV. Unsubscribe from StrangCraftTV? From Google Maps and heightmaps to 3D Terrain - 3D Map Generator Terrain - Photoshop. Kovka 3d polnaya versiya. Zy Zy polnaya versiya StrangCraftTV. Unsubscribe from StrangCraftTV? From Google Maps and heightmaps to 3D Terrain - 3D Map Generator Terrain - Photoshop - Duration: 11:35.

In the Definitive Guide to Position Sizing Strategies you’ll discover the following: • Psychological biases that discourage your use of position sizing strategies • How to understand low-risk ideas. • Systematic approaches to evaluate your system’s performance including a thorough explanation of Van’s System Quality Number ® rating process • Van’s method for defining the six market types and how you can determine in which markets your system will work best – or at all. • Some simple and some complex ways how to let your winners win big and cut your losses short. • How you use position sizing strategies to meet your objectives. • How to create effective and robust objectives for your trading. • Six realistic methods that you could use to limit your potential for ruin or to limit large drawdowns in your account.